General

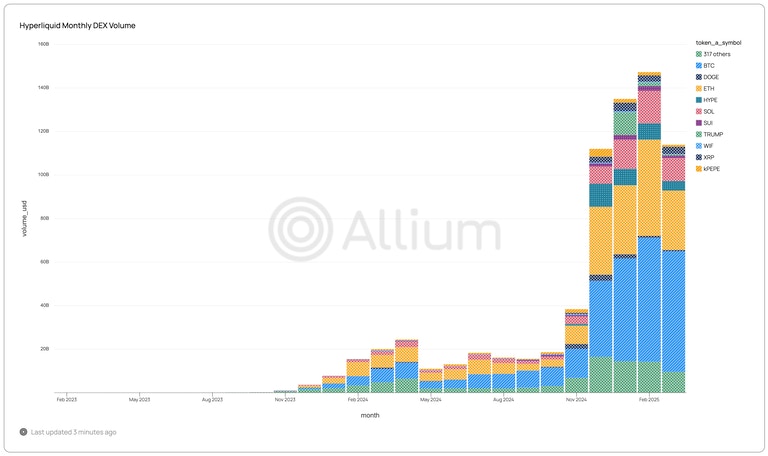

Sample queries for Hyperliquid historical data. This queries are applicable to Hyperliquid data on Snowflake dat awarehouse. Get total monthly DEX volume on Hyperliquid over time

Copy

Ask AI

SELECT

DATE_TRUNC('MONTH', timestamp) AS month,

token_a_symbol,

SUM(usd_amount) AS volume_usd

FROM hyperliquid.dex.trades

GROUP BY ALL

Copy

Ask AI

select

*

from hyperliquid.dex.trades

where 1=1

and (buyer_address = <address_to_search> or seller_address = <address_to_search>)

Copy

Ask AI

select

*

from hyperliquid.dex.trades

where 1=1

and token_a_symbol = 'BTC'

and timestamp >= current_timestamp - interval '24 hours'

Copy

Ask AI

select

token_a_symbol,

sum(case when market_type = 'spot' then usd_amount else 0 end) as total_spot_usd_amount,

sum(case when market_type = 'perpetuals' then usd_amount else 0 end) as total_perpetuals_usd_amount,

sum(usd_amount) as total_usd_amount,

from hyperliquid.dex.trades

where 1=1

and timestamp >= current_timestamp - interval '24 hours'

group by all

order by total_usd_amount desc

Copy

Ask AI

select

date(timestamp) as day,

token_a_symbol,

count(distinct buyer_address) as num_buyers,

count(distinct seller_address) as num_sellers,

sum(usd_amount) as total_usd_amount,

from hyperliquid.dex.trades

where 1=1

and timestamp >= current_timestamp - interval '7 days'

group by all

order by 1 asc

By Use Case

- Market Structure Insights

- Behaviour Analysis

- Liquidity Movement Patterns

We can use some simple queries to view market resistance levels for the last 24 hours. (For more sophisticated clustering consider exporting the data and usind statiscal tools to identify clusters.)

Please be advised that this data is currently incomplete as open orders are still missing. We are working to complete this data set. However this will give you some sense of the levels.

- Limit losses levels

- The query below give you levels where traders are more likely to sell to limit their losses.

Copy

Ask AI

-- Dynamic binning for Stop orders based on each coin's price range

WITH coin_price_ranges AS (

SELECT

COIN,

MIN(TRIGGER_PRICE) as min_price,

MAX(TRIGGER_PRICE) as max_price,

(MAX(TRIGGER_PRICE) - MIN(TRIGGER_PRICE))/20 as bin_size -- Create 20 bins across the range

FROM hyperliquid.raw.orders

WHERE IS_TAKE_PROFIT_OR_STOP_LOSS = TRUE

AND TYPE IN ('Stop Market', 'Stop Limit')

AND STATUS_CHANGE_TIMESTAMP >= DATEADD(hour, -24, CURRENT_TIMESTAMP())

GROUP BY COIN

)

SELECT

o.COIN,

'Stop Orders' as order_category,

FLOOR(o.TRIGGER_PRICE / NULLIF(r.bin_size, 0)) * r.bin_size as price_bin_start,

(FLOOR(o.TRIGGER_PRICE / NULLIF(r.bin_size, 0)) + 1) * r.bin_size as price_bin_end,

COUNT(*) as order_count

FROM hyperliquid.raw.orders o

JOIN coin_price_ranges r ON o.COIN = r.COIN

WHERE o.IS_TAKE_PROFIT_OR_STOP_LOSS = TRUE

AND o.TYPE IN ('Stop Market', 'Stop Limit')

AND o.STATUS_CHANGE_TIMESTAMP >= DATEADD(hour, -24, CURRENT_TIMESTAMP())

GROUP BY o.COIN, order_category, FLOOR(o.TRIGGER_PRICE / NULLIF(r.bin_size, 0)) * r.bin_size, (FLOOR(o.TRIGGER_PRICE / NULLIF(r.bin_size, 0)) + 1) * r.bin_size

ORDER BY o.COIN, price_bin_start;

- Take Profit Levels

- This will give you the levels where traders are more likely to take profits.

Copy

Ask AI

-- Dynamic binning for Take Profit orders based on each coin's price range

WITH coin_price_ranges AS (

SELECT

COIN,

MIN(TRIGGER_PRICE) as min_price,

MAX(TRIGGER_PRICE) as max_price,

(MAX(TRIGGER_PRICE) - MIN(TRIGGER_PRICE))/20 as bin_size -- Create 20 bins across the range

FROM hyperliquid.raw.orders

WHERE IS_TAKE_PROFIT_OR_STOP_LOSS = TRUE

AND TYPE IN ('Take Profit Market', 'Take Profit Limit')

AND STATUS_CHANGE_TIMESTAMP >= DATEADD(hour, -24, CURRENT_TIMESTAMP())

GROUP BY COIN

)

SELECT

o.COIN,

'Take Profit Orders' as order_category,

FLOOR(o.TRIGGER_PRICE / NULLIF(r.bin_size, 0)) * r.bin_size as price_bin_start,

(FLOOR(o.TRIGGER_PRICE / NULLIF(r.bin_size, 0)) + 1) * r.bin_size as price_bin_end,

COUNT(*) as order_count

FROM hyperliquid.raw.orders o

JOIN coin_price_ranges r ON o.COIN = r.COIN

WHERE o.IS_TAKE_PROFIT_OR_STOP_LOSS = TRUE

AND o.TYPE IN ('Take Profit Market', 'Take Profit Limit')

AND o.STATUS_CHANGE_TIMESTAMP >= DATEADD(hour, -24, CURRENT_TIMESTAMP())

GROUP BY o.COIN, order_category, FLOOR(o.TRIGGER_PRICE / NULLIF(r.bin_size, 0)) * r.bin_size, (FLOOR(o.TRIGGER_PRICE / NULLIF(r.bin_size, 0)) + 1) * r.bin_size

ORDER BY o.COIN, price_bin_start;

- Circular Trading - two addresses trading back and forth

Copy

Ask AI

WITH trading_pairs AS (

SELECT

BUYER_ADDRESS,

SELLER_ADDRESS,

COIN,

COUNT(*) as trade_count,

SUM(USD_AMOUNT) as total_volume

FROM hyperliquid.dex.trades

WHERE TIMESTAMP >= DATEADD(day, -30, CURRENT_TIMESTAMP()) -- Last 30 days

GROUP BY BUYER_ADDRESS, SELLER_ADDRESS, COIN

HAVING COUNT(*) >= 10 -- At least 10 trades between the same pair

),

reverse_pairs AS (

SELECT

a.BUYER_ADDRESS,

a.SELLER_ADDRESS,

a.COIN,

a.trade_count as forward_count,

b.trade_count as reverse_count,

a.total_volume as forward_volume,

b.total_volume as reverse_volume

FROM trading_pairs a

JOIN trading_pairs b ON a.BUYER_ADDRESS = b.SELLER_ADDRESS

AND a.SELLER_ADDRESS = b.BUYER_ADDRESS

AND a.COIN = b.COIN

WHERE a.BUYER_ADDRESS < a.SELLER_ADDRESS -- To avoid duplicate pairs

)

SELECT

BUYER_ADDRESS,

SELLER_ADDRESS,

COIN,

forward_count,

reverse_count,

forward_count + reverse_count as total_trades,

forward_volume,

reverse_volume,

forward_volume + reverse_volume as total_volume,

ABS(forward_count - reverse_count) / (forward_count + reverse_count) as trade_count_imbalance,

ABS(forward_volume - reverse_volume) / (forward_volume + reverse_volume) as volume_imbalance

FROM reverse_pairs

ORDER BY total_trades DESC;

Monitor big movements

Predict what is happening in the market

- Identify top sellers in the last month

Copy

Ask AI

SELECT

SELLER_ADDRESS,

SUM(USD_AMOUNT) as TOTAL_SOLD_USD,

COUNT(*) as NUMBER_OF_SALES

FROM hyperliquid.dex.trades

WHERE TIMESTAMP >= DATEADD(month, -1, CURRENT_TIMESTAMP())

AND SELLER_ADDRESS IS NOT NULL

GROUP BY SELLER_ADDRESS

ORDER BY TOTAL_SOLD_USD DESC

LIMIT 20;

- Identify Top Buyers

Copy

Ask AI

SELECT

BUYER_ADDRESS,

SUM(USD_AMOUNT) as TOTAL_BOUGHT_USD,

COUNT(*) as NUMBER_OF_PURCHASES

FROM hyperliquid.dex.trades

WHERE TIMESTAMP >= DATEADD(month, -1, CURRENT_TIMESTAMP())

AND BUYER_ADDRESS IS NOT NULL

GROUP BY BUYER_ADDRESS

ORDER BY TOTAL_BOUGHT_USD DESC

LIMIT 20;

- Monitor the above addresses for open trades (coming soon)

For now you can view what these whales have been doing by removing the o.STATUS = ‘open’, which will show you all the order status changes, so will capture a lot of the movement, but any orders that were placed and have not been cancelled, modified or filled, will not be visible.

Copy

Ask AI

-- First, create a CTE (Common Table Expression) with top sellers

WITH top_sellers AS (

SELECT

SELLER_ADDRESS as ADDRESS

FROM hyperliquid.dex.trades

WHERE TIMESTAMP >= DATEADD(month, -1, CURRENT_TIMESTAMP())

AND SELLER_ADDRESS IS NOT NULL

GROUP BY SELLER_ADDRESS

ORDER BY SUM(USD_AMOUNT) DESC

LIMIT 10

),

-- Create a CTE with top buyers

top_buyers AS (

SELECT

BUYER_ADDRESS as ADDRESS

FROM hyperliquid.dex.trades

WHERE TIMESTAMP >= DATEADD(month, -1, CURRENT_TIMESTAMP())

AND BUYER_ADDRESS IS NOT NULL

GROUP BY BUYER_ADDRESS

ORDER BY SUM(USD_AMOUNT) DESC

LIMIT 10

),

-- Combine the two lists (with possible duplicates)

top_traders AS (

SELECT ADDRESS FROM top_sellers

UNION

SELECT ADDRESS FROM top_buyers

)

-- Now query the orders table for these addresses

SELECT

o.CLIENT_ORDER_ID,

o.ORDER_ID,

o.COIN,

o.IS_TAKE_PROFIT_OR_STOP_LOSS,

o.IS_TRIGGER,

o.TYPE,

o.ORIGINAL_SIZE,

o.IS_REDUCE_ONLY,

o.SIDE,

o.SIZE,

o.TIME_IN_FORCE,

o.ORDER_TIMESTAMP,

o.TRIGGER_CONDITION,

o.TRIGGER_PRICE,

o.LIMIT_PRICE,

o.CHILDREN,

o.STATUS,

o.USER,

o.STATUS_CHANGE_TIMESTAMP

FROM hyperliquid.raw.orders o

JOIN top_traders t ON o.USER = t.ADDRESS

WHERE o.STATUS = 'open'

AND o.ORDER_TIMESTAMP >= DATEADD(hour, -24, CURRENT_TIMESTAMP())

ORDER BY o.ORDER_TIMESTAMP DESC;

- Most profitable traders

Copy

Ask AI

WITH buyer_pnl AS (

SELECT

BUYER_ADDRESS AS ADDRESS,

SUM(CAST(PARSE_JSON(_EXTRA_FIELDS):buyer:closed_pnl as FLOAT)) AS BUYER_TOTAL_PNL

FROM hyperliquid.dex.trades

WHERE _EXTRA_FIELDS IS NOT NULL

AND PARSE_JSON(_EXTRA_FIELDS):buyer:closed_pnl IS NOT NULL

AND BUYER_ADDRESS IS NOT NULL

AND TIMESTAMP >= DATEADD(day, -7, CURRENT_TIMESTAMP())

GROUP BY BUYER_ADDRESS

),

seller_pnl AS (

SELECT

SELLER_ADDRESS AS ADDRESS,

SUM(CAST(PARSE_JSON(_EXTRA_FIELDS):seller:closed_pnl as FLOAT)) AS SELLER_TOTAL_PNL

FROM hyperliquid.dex.trades

WHERE _EXTRA_FIELDS IS NOT NULL

AND PARSE_JSON(_EXTRA_FIELDS):seller:closed_pnl IS NOT NULL

AND SELLER_ADDRESS IS NOT NULL

AND TIMESTAMP >= DATEADD(day, -7, CURRENT_TIMESTAMP())

GROUP BY SELLER_ADDRESS

),

combined_pnl AS (

SELECT

COALESCE(b.ADDRESS, s.ADDRESS) AS ADDRESS,

COALESCE(b.BUYER_TOTAL_PNL, 0) AS BUYER_TOTAL_PNL,

COALESCE(s.SELLER_TOTAL_PNL, 0) AS SELLER_TOTAL_PNL,

COALESCE(b.BUYER_TOTAL_PNL, 0) + COALESCE(s.SELLER_TOTAL_PNL, 0) AS TOTAL_PNL

FROM buyer_pnl b

FULL OUTER JOIN seller_pnl s ON b.ADDRESS = s.ADDRESS

)

SELECT

ADDRESS,

BUYER_TOTAL_PNL,

SELLER_TOTAL_PNL,

TOTAL_PNL,

CASE

WHEN TOTAL_PNL > 0 THEN 'Profitable'

WHEN TOTAL_PNL < 0 THEN 'Loss'

ELSE 'Breakeven'

END AS PERFORMANCE

FROM combined_pnl

ORDER BY TOTAL_PNL DESC

LIMIT 100;

Builder Fees

- Average fee by builder address

Copy

Ask AI

-- avg fee by builder address

SELECT

action:builder:b as builder_address,

COUNT(*) as transaction_count,

AVG(action:builder:f) as average_fee

FROM hyperliquid.raw.transactions

WHERE action:builder:b IS NOT NULL

GROUP BY action:builder:b

ORDER BY average_fee DESC;

- Min, Max and Avg - Max Builder Fee per builder builder

Copy

Ask AI

SELECT

action:builder as builder_address,

MIN(

TRY_TO_DECIMAL(

REPLACE(

REPLACE(action:maxFeeRate::string, '%', ''),

' ', ''

)

) / 100

) as min_max_fee_rate,

MAX(

TRY_TO_DECIMAL(

REPLACE(

REPLACE(action:maxFeeRate::string, '%', ''),

' ', ''

)

) / 100

) as max_max_fee_rate,

AVG(

TRY_TO_DECIMAL(

REPLACE(

REPLACE(action:maxFeeRate::string, '%', ''),

' ', ''

)

) / 100

) as avg_max_fee_rate,

COUNT(*) as approval_count,

MIN(action:nonce) as first_approval,

MAX(action:nonce) as latest_approval

FROM hyperliquid.raw.transactions

WHERE action:type::string = 'approveBuilderFee'

AND action:maxFeeRate IS NOT NULL

GROUP BY builder_address

ORDER BY avg_max_fee_rate DESC;

Vaults

- Transfers, deposits by vault and user

Copy

Ask AI

SELECT

user,

action:vaultAddress AS vault_address,

SUM(CASE WHEN action:isDeposit = true THEN action:usd ELSE 0 END) AS total_deposits,

SUM(CASE WHEN action:isDeposit = false THEN action:usd ELSE 0 END) AS total_withdrawals

FROM hyperliquid.raw.transactions

WHERE action:type = 'vaultTransfer'

GROUP BY user, vault_address

ORDER BY user, vault_address;

- Transfers and deposits by vault

Copy

Ask AI

SELECT

action:vaultAddress AS vault_address,

SUM(CASE WHEN action:isDeposit = true THEN action:usd ELSE 0 END) AS total_deposits,

SUM(CASE WHEN action:isDeposit = false THEN action:usd ELSE 0 END) AS total_withdrawals,

COUNT(DISTINCT user) AS users

FROM hyperliquid.raw.transactions

WHERE action:type = 'vaultTransfer'

GROUP BY vault_address

ORDER BY total_deposits DESC;

HyperCore <> HyperEVM

Transfers

HyperCore -> HyperEVM

Copy

Ask AI

SELECT *

FROM hyperliquid.raw.transactions

WHERE

action:type = 'SystemSpotSendAction'

LIMIT 2;

action:destination will be the user address it is going to.

So to filter by user you would do

Copy

Ask AI

SELECT *

FROM hyperliquid.raw.transactions

WHERE

action:type = 'SystemSpotSendAction'

AND

action:destination = '0x6b00f08f81d81fec5154b6e807acd4613cd16795'

LIMIT 2;

HyperEVM -> HyperCore

Copy

Ask AI

SELECT *

FROM hyperliquid.raw.transactions

WHERE

action:type = 'spotSend'

AND

(

action:destination like '0x20%'

OR

action:destination = '0x2222222222222222222222222222222222222222'

)

LIMIT 2;

Every token has a system address on the Core, which is the address with first byteTo filter by user, use the user column, as the token will be deposited in the address of the user who intiated the transaction.0x20and the remaining bytes all zeros, except for the token index encoded in big-endian format. The exception is HYPE, which has a system address of0x2222222222222222222222222222222222222222.

Copy

Ask AI

SELECT *

FROM hyperliquid.raw.transactions

WHERE

action:type = 'spotSend'

AND

(

action:destination like '0x20%'

OR

action:destination = '0x2222222222222222222222222222222222222222'

)

AND

user = '0xc0617cf0557378d4d53fd17320ae4e6e2c27e468'

LIMIT 2;